The Only Futures Trading Terminal Designed for Multi-Prop Cross-Copy Precision

Built for traders who manage risk professionally, scale accounts systematically, and demand total control on the go.

The Ultimate Multi-Prop Trader Swiss-Knife

Every feature designed to give you the edge in fast-moving markets with multiple accounts across multiple firms.

.B_UINvdQ.webp)

.B_UINvdQ.webp)

Manage every account type—evaluation, sim, funded, personal—on one platform.

Instant reconnect, liquidation, or failover handling.

Detailed broker connection view with full control and health monitoring.

Live P&L, net liquidation, and per-account performance.

Set DLL, profit targets, scaling type and contract caps for each account.

Create unlimited account groups based on your own criteria.

Auto-calculate size per account using custom multipliers, sizing and scaling type (micro or mini).

Rogue tweet? Surprise war? Every trade protected with a SL+TP bracket.

Aggregate view of all open positions and orders across groups.

The ultimate execution edge. Manage 100+ positions in seconds with a tap, no stress.

Manage all accounts on one platform

Manage every account type—evaluation, sim, funded, personal—on one mobile platform.

Why it matters: No switching apps, logins, or dashboards. Your entire trading ecosystem lives in your pocket.

- Works with any Tradovate/Ninjatrader and Rithmic prop funding firm and account

- Real-time connection status monitoring

- Dedicated & exclusive: Hosted on your own VPS cloud infrastructure for 24/7 reliability

Instant emergency actions

Instant reconnect, liquidation, or failover handling.

Why it matters: Markets move fast. Things can go wrong. Protecting capital in volatile moments requires fast response tools.

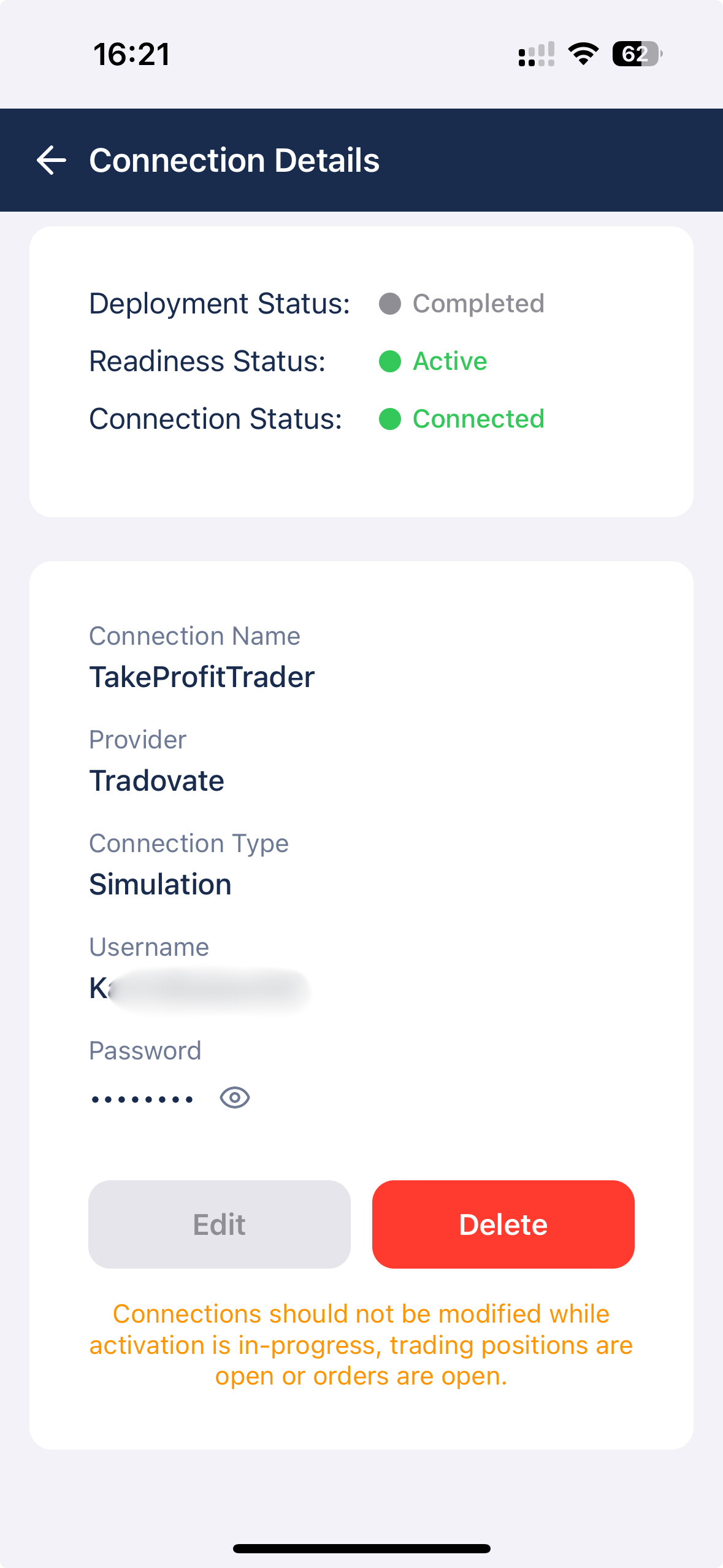

Detailed connection view

Detailed broker connection view with full control and health monitoring.

Why it matters: Know exactly what's connected and how it's performing—no more blind spots.

- Deployment & Readiness Status

- Connection Status

- Secure credential management

Real-time account overview

Live P&L, net liquidation, and per-account performance.

Why it matters: Trade confidently with total awareness of every account's stats and rake those gains.

Per-account risk controls

Set DLL, profit targets, scaling type and contract caps for each account.

Why it matters: Protect each account independently and for its own size and health. Meet strict prop firm rules without slip-ups.

Custom group management

Create unlimited account groups based on your own criteria.

Why it matters: Structure your portfolio like a professional desk—segment risk and trade smart. "Copy to all" won't just cut it.

Auto-calculate position sizes

Auto-calculate size per account using custom multipliers, sizing and scaling type (micro or mini).

Why it matters: Avoid overexposure and size mistakes when trading across mixed account sizes. In trading, one shoes does NOT fit all.

Built-in bracket orders

Rogue tweet? Surprise war? Every trade protected with a SL+TP bracket.

Why it matters: No missed exits or stops. No hope instead of fear. No "TP hit but I forgot to remove the SL order". One-cancels-Other set-and-forget safety from the first tap.

Unified position & order view

Why it matters: One aggregated position with realtime P&L tracking.

- Positions aggregated per instrument

- Real-time P&L calculation

- Per-account order cards

Group position controls

Why it matters: Manage 100+ positions in seconds with a tap.

💡 Scale Your Edge—Not Your Risk

You don't need to upsize trades to grow your profits. You need smart tools to scale horizontally across accounts.

Three Plans. Built for Every Trader.

Choose the plan that matches your trading operation—from self-hosted to fully managed infrastructure.

✅ Included in Every Plan:

Both trials include 14 days of full access. Only one trial per user.

Frequently Asked Questions

Everything you need to know about PropTerminal

PropTerminal supports Tradovate, NinjaTrader and Rithmic (with or without Ninjatrader support) brokerage connections. We've tested all major prop trading firms including MyFundedFutures, TakeProfitTrader, Tradeify, Elite Trader Funding, APEX, TickTickTrader, TradeDay, Alpha Futures, TFD, Lucid Trading, Bulenox and many more.

The smart position sizing system is sophisticated and works through a multi-layered calculation process:

1. User Input Layer

- • User selects a base multiplier (e.g., 1, 2, 3) during the creation of a trade entry

- • User chooses instrument type (mini or micro contracts)

- • System shows real-time preview of calculated positions for each account

2. Account-Level Scaling

Each account has two key parameters set in risk and consistency parameters:

- Scaling Type:

- • "up" - Simple multiplication (2 × 3 = 6 contracts)

- • "micro" - Converts minis to micros with multiplication

- Scaling Value: The multiplier (1, 2, 3, 4, etc.)

3. The Smart Calculation

For "Up" Scaling:

Final Size = Base Multiplier × Scaling Value (capped at account's max_size)

For "Micro" Scaling:

- • If trading minis: Final Size = Base Multiplier × Scaling Value (converted to micros)

- • If trading micros: Final Size = Base Multiplier (no additional scaling)

4. Real Example

User trades 2 mini ES contracts across a group with 3 accounts:

- • Account A (up scaling ×3): Gets 6 mini ES contracts

- • Account B (micro scaling ×4): Gets 8 micro MES contracts

- • Account C (micro scaling ×2): Gets 4 micro MES contracts

5. Risk Protection

- • Each position respects the account's max_size limit

- • DLL/DPT limits are enforced per account

- • Automatic instrument conversion (ES→MES) happens seamlessly

6. Group Trading Magic

- • One order entry creates multiple positions with different sizes

- • Each account gets its optimal position size based on its configuration

- • Preview shows all calculations before execution

This allows prop traders to scale strategies across accounts with different risk profiles while maintaining precise control over position sizing - all with a single trade entry.

Intelligent Position Grouping

Your positions are automatically organized into smart groups based on instrument, direction, and entry price range. Instead of seeing individual positions scattered across accounts, you'll see consolidated views like "ES LONG - 3 mini + 5 micro" with combined P&L tracking.

One-Tap Power Actions

Close All Positions

- • Every position group has a prominent "Close All" button

- • Instantly exits all positions in that group across all accounts

- • Visual feedback shows positions being closed

Move to Breakeven

- • Single tap moves all stop losses to your average entry price

- • Works across entire position groups

- • Perfect for locking in risk-free trades

Dynamic Stop Loss & Take Profit Management

Update Protection Levels

- • Change your stop loss or take profit prices on the fly

- • Enter new price levels and update entire position groups instantly

- • No need to modify positions individually

Trailing Controls

- • Interactive sliders let you set trailing distances (0-25 points)

- • Trail your stops to protect profits as markets move in your favor

- • Trail your take profits to capture extended moves

- • Apply trailing to entire position groups with one tap

Expandable Position Cards

Quick View (Collapsed)

- • See essential info at a glance: size, direction, P&L

- • Quick access to "Close All" button

- • Real-time profit/loss updates with color coding

Detailed View (Expanded)

- • Full breakdown of positions by account

- • Access to all advanced management tools

- • Individual position details with entry prices

- • Complete control panel for modifications

Smart Filtering & Real-Time Updates

Smart Filtering

- • Filter positions by individual accounts or custom groups

- • Quickly focus on specific strategies or account sets

- • Horizontal scrolling for easy navigation

Real-Time Everything

- • Live P&L calculations with current market prices

- • Instant position updates when orders fill

- • Visual indicators for significant P&L moves

- • Automatic refresh with pull-down gesture

The Power of Group Management

The system recognizes when positions across multiple accounts belong together and treats them as one. This means you can:

- • Manage 10 positions as easily as 1

- • Apply changes to entire strategies instantly

- • Never lose track of correlated positions

- • Make faster decisions with consolidated data

All these features work together to give you lightning-fast control over complex multi-account positions, turning what would be dozens of individual actions into single taps.

Absolutely! You can organize accounts into groups and combinations however you like, for example, you can have groups "Evals", "Funded", "Funded in Trailing", and "Live Funded". There are no restrictions on grouping. An account can also exist in multiple groups, for maximum flexibility.

With a single tap, you can move all stop losses across all your positions to breakeven, protecting your capital while letting winners run. The stops are placed a few ticks above entry (or below for short positions) to account for slippage and commission fees. This way, you never exit the position at a loss if the stop market order got triggered. This is a useful features, particularly for acounts with End-Of-Day trailing.

Our VPS-based infrastructure architecture ensures your trades continue executing even if your internet connection drops. The system automatically reconnects and synchronizes your positions when connectivity is restored. You'll see real-time connection status for each platform (Active/Connected) in the app, plus emergency "Reconnect All" functionality to restore all connections instantly. Even with a 99.99% infrastructure availability, if in the rare case, the VPS lost connectivity, your OCO SL/TP bracket order is already placed and accepted by the broker and will be executed regardless of the connectivity state of your PropTerminal app or your dedicated VPS infrastructure. Statistically, the risk of a rogue tweet is much higher than any of these connectivity loss events.

Extremely detailed. You can view all orders across accounts with real-time status updates (Open, Filled, Cancelled), filter by account groups (for example, All Accounts, "Evals", "Funded", ...), and cancel orders with one tap. The system tracks every order type including limit orders, market orders, and their respective purpose-label for Entry, take profits (TP), and stop losses (SL) with complete visibility into size, price, and account allocation.

Extremely detailed. You can set daily loss limits, profit targets, scaling values, max position sizes, and choose between micro/mini contract scaling for each individual account. The system tracks realized P&L, unrealized P&L, net liquidation, and max drawdown in real-time for every account. Your complete portfolio overview shows total net liquidation, realized and unrealized profits across all accounts.

No, since we use 3rd-party per-user licenses for PT Desktop and 3rd-party cloud infrastructure providers for your dedicated VPS hosting for PT PRO and Elite plans. However, we offer a 14-day PAID trial for a symbolic price of $14 and $33 with full access to all features of the Desktop and PRO subscriptions, respectively. You can connect your accounts and test all functionality including multi-account execution, position management, OCO protection, and risk controls before committing to a monthly or yearly paid plan.

Ready to Transform Your Prop Trading?

Join thousands of professional traders who've already made the switch to mobile-first prop trading.